Then work out what you need to spend – and put a figure towards saving.īe realistic and don’t cut back so much you can’t stick to it. Once you’ve added up your total essential expenditure on the spreadsheet, take it away from your monthly income.

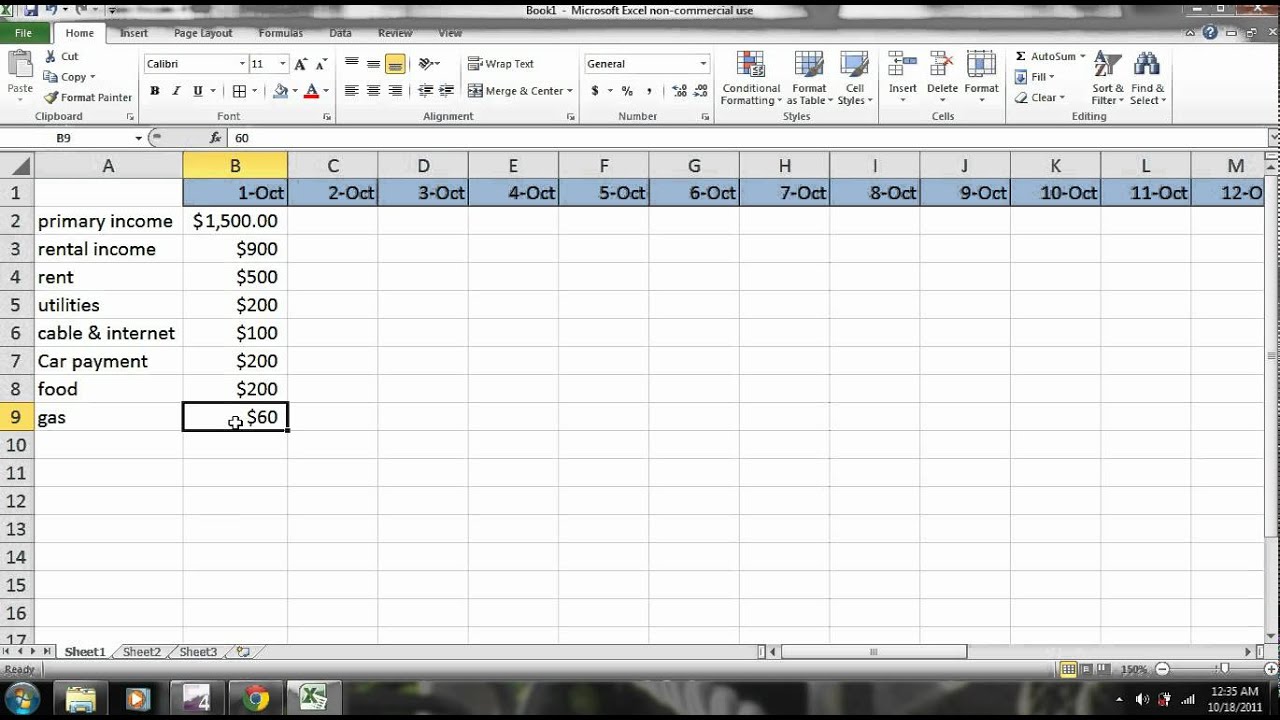

Start your spreadsheet by putting in all your essential spendings. If you’re out of contract with your internet service provider or energy company, look at switching, or call them to see if you can get a better deal. If you’ve been paying for a subscription you aren’t using – end it. Use this as a chance to look at anywhere you could easily cut costs. ‘Understanding where every penny goes can help identify where you’re potentially overspending.’ Where could you cut back? Hayley Millhouse, MD of low-cost financial advice platform OpenMoney says: ‘It’s a good idea to review the past few months expenditure and create a monthly budget including mortgage/rent, bills, groceries, transport costs, spending money and savings. Include every regular payment you make on the spreadsheet by going through your bank statements for the last few months. While you might have a vague idea, sometimes when you really note down every single bill, you’re surprised at the total amount. Start by working out how much you must spend each month If you’re budgeting with a partner, you can make sure you both have access to keep track of your shared finances. Make it accessible on your phone, computer, and tablet so you can note things down as they happen, rather than saving them up and forgetting.

Rather than choosing a notebook or a document saved on one computer, use a cloud based spreadsheet like a Google Doc or an app specifically for money management. ‘Once it is clear where your money is going you will start to be able to make changes and become more mindful with your money as we head into 2021.’ Make it easy to access

0 kommentar(er)

0 kommentar(er)